If you’re buying, selling, refinancing, going through a divorce, or dealing with tax or legal matters, understanding real estate appraisals is essential. Below are the most frequently asked real estate appraisal questions homeowners, buyers, lenders, and attorneys ask before ordering an appraisal.

1. What is a real estate appraisal and why is it important?

A real estate appraisal is a professional, unbiased opinion of a property’s value completed by a licensed or certified real estate appraiser. The goal is to determine market value based on data, analysis, and current market conditions.

Appraisals are commonly used for:

- Home purchases and refinances

- Divorce and legal disputes

- Estate settlement and trust planning

- Property tax appeals

- Investment and financial planning

Lenders, attorneys, courts, buyers, and sellers rely on appraisals to ensure property values are accurate, defensible, and market-supported.

2. What factors influence a home appraisal?

Many factors affect a property’s value. The most important include:

- Location and neighborhood demand

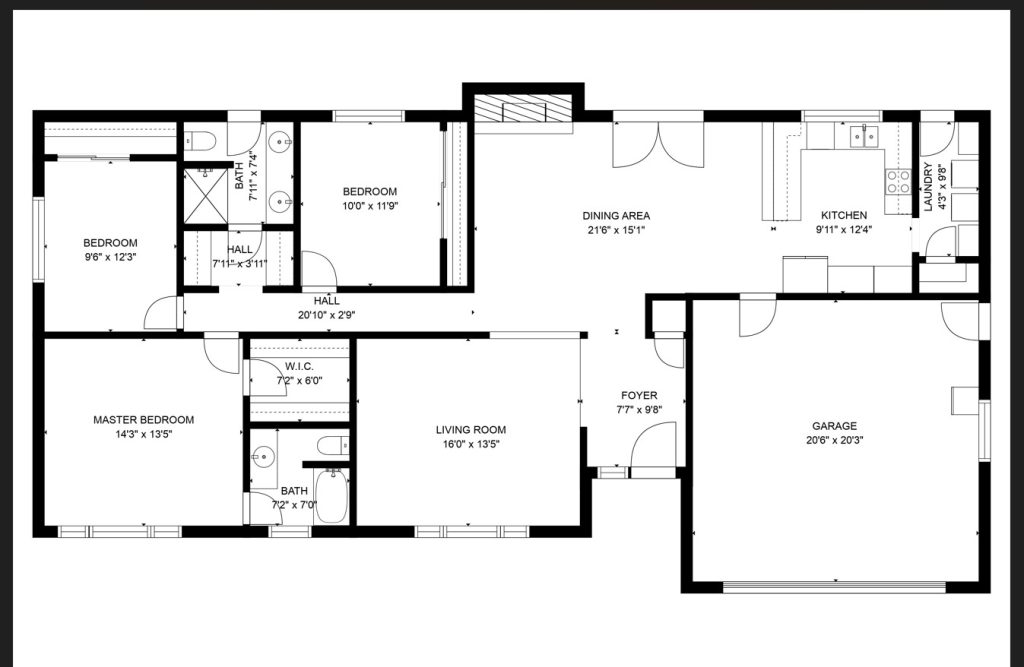

- Size, layout, and square footage

- Condition and upgrades

- Age and quality of construction

- Lot size and usable land

- Recent comparable sales (“comps”)

- Current supply and demand in the housing market

Appraisers analyze recent closed sales, current listings, and pending sales to determine how the market is behaving.

3. How can I prepare for a home appraisal?

To present your property in its best light:

- Clean and declutter the home

- Complete minor repairs and maintenance

- Provide a list of upgrades or renovations

- Ensure full access to the property

Remember: Appraisers analyze market reaction to a property. Cosmetic updates, along with functional improvements, can contribute to value when they improve overall appeal and competitiveness in the marketplace.

4. Should I get an appraisal before buying or listing a property?

An independent appraisal can provide valuable insight into a home’s true market value before listing or making an offer.

For sellers, an appraisal can help set a realistic listing price and reduce surprises during escrow.

For buyers, an appraisal offers an objective analysis of value and helps guide negotiations.

5. Can the same appraisal be used for multiple purposes?

No. Each appraisal is developed for a specific intended use and intended user.

Because of liability and confidentiality requirements, an appraisal prepared for one purpose (Pre-listing) cannot automatically be reused for another purpose (such as divorce or estate settlement).

6. What is the difference between appraised value and assessed value?

This is one of the most searched appraisal questions online.

Appraised Value

- Determined by a licensed/certified appraiser

- Reflects market value

- Used for buying, selling, refinancing, divorce, and legal matters

Assessed Value

- Determined by the local tax assessor

- Used only for property tax purposes

- Often based on mass appraisal models and may lag behind the market

Assessed value is not the same as market value and should not be used to determine a home’s selling price.

7. Who orders the appraisal for lending purposes?

For Lending purposes, the lender orders the appraisal, not the buyer, seller, or real estate agent.

Federal lending regulations require the lender to engage the appraiser through an independent process to ensure the appraisal remains objective, unbiased, and free from outside influence. Even though the borrower typically pays for the appraisal, the appraiser’s client in lending assignments is the lender.

Lenders require an appraisal to:

- Confirm the home’s market value supports the loan amount

- Protect the borrower and the lending institution

- Meet federal appraisal independence requirements

If you need an appraisal for a purpose other than lending—such as divorce, estate planning, tax appeals, or private sales—you can hire a real estate appraiser directly.

8. How do appraisers determine a home’s value?

Appraisers use three recognized valuation approaches:

Sales Comparison Approach (most relied upon)

This is the primary method used for residential properties.

Recent comparable sales are analyzed to determine what buyers are currently paying for similar homes.

Cost Approach (primarily used for new or unique properties)

Estimates the cost to rebuild the home today, minus depreciation and any forms of obsolescence (physical, functional, or external).

This approach is most useful for:

- New construction

- Unique homes

- Insurance purposes

Income Approach (for rental properties)

Analyzes rental income and investment return.

Primarily used for investment and rental properties.

The final opinion of value considers all applicable approaches and current market conditions.

9. What is the difference between Market Value and Fair Market Value?

These terms are often confused.

Market Value

The most probable price a property should sell for in a competitive and open market under normal conditions.

This is the standard used for most appraisals, including lending and divorce.

Fair Market Value

Defined by the U.S. Treasury and used for IRS and tax reporting, such as:

- Estate appraisals

- Gift tax valuations

- Charitable contributions

In typical real estate transactions, the terms often produce similar results, but the definition source matters depending on the intended use.

10. How is an appraisal different from a home inspection?

This is a very important distinction.

Real Estate Appraisal

Focus: Value

- Estimates market value

- Analyzes comparable sales and market data

- Performs a visual observation of the property

- Identifies major features and overall condition

Home Inspection

Focus: Condition and safety

- Evaluates structural components

- Examines roof, plumbing, electrical, HVAC, and systems

- Identifies defects and safety concerns

- Provides a detailed condition report

An appraiser is not a home inspector, and a home inspector does not determine value. Both services play different but complementary roles in real estate transactions.

Still Have Real Estate Appraisal Questions?

If you still have real estate appraisal questions, need guidance on the appraisal process, or require an appraisal for lending, divorce, estate planning, or tax purposes, Larson Appraisal is here to help.

Learn more about appraisal standards from The Appraisal Foundation.